|

| What does Independence mean for former colonies |

|

How its leaders forge cohesion, heal social wounds will be true test of maturity in next 60 years

ON SEPT 16, Malaysia celebrates her 57th national day, having celebrated on Aug 31 the 63rd anniversary of independence from Britain in 1957.

What does Independence mean for former colonies?

It means that a nation is free to choose its own future independent from imperial influence. Lest we forget, colonisation in Asia arrived in the 16th century with Portuguese, Dutch and British pirateers who came, saw and conquered. They did this in the name of their king and Christianity, but it was mostly for their own well-being.

No statistic illustrates this better than the stark fact that India before colonisation in 1700 accounted for 24.4% of world GDP (Maddison, 2007) and by independence in 1947, her share was down to only 4.2% in 1950. Of course, the British left behind the English language, the rule of law and a durable administrative structure that is still being practised in many former colonies.

We should also be grateful that decolonisation (shedding of empires by the European powers) was encouraged by the post-war American administration, which basically did not want any challenges to her dominant status, British cousins or not. The result was that Hong Kong was the last of the colonies to lose her status in 1997. Considering that some Hong Kongers are still waving the Union Jack, colonial nostalgia has not lost all its fans

What matters is what the newly independent countries achieved with their sovereignty. Singapore is the exemplar that pulled herself into the ranks of advanced income status by sheer grit and determination, having almost no natural resources. Myanmar, on the other hand, was richly endowed with natural resources and had one of the best educated elites at independence in 1948. Ruled mostly by the military junta, her growth has been stunted relative to her neighbours.

The Asian Development Bank has just published an excellent book on Asia’s Journey to Prosperity, commemorating 50+ years of its establishment in 1966. The book tracked Asia’s transformation from a post-colonial era of essentially rural Asia to today’s urban and technologically driven region that accounts for roughly half of global growth.

Seen from a 60-year cycle, Asia’s transformation has been world-shattering. In 1960, Developing Asia (ex-Japan) accounted for only 4.1% of world GDP, measured in constant 2010 USD terms. That year, the EU accounted for 36.2% and the United States 30.6% respectively, together 18 times larger.

Japan was already a developed country with 7.0% of world GDP. By 2018, Developing Asia’s share increased six times to 24.0%, on par with the EU (23.2%) and the US (23.9%). This means that including Japan, Asia accounted for 31.5% of world GDP. The global GDP shares for Latin America, the Middle East, Africa and rest of the world were essentially unchanged in the last half century.

In other words, the loss in share of world GDP by Europe and the US between 1960-2018 was largely gained by Developing Asia, of which China was in its own class. China’s GDP grew 84 times over this period, whereas the other three Asian dragons, South Korea, Taiwan and Singapore, grew between 55 to 58 times. By comparison, over the same period, OECD countries, including Japan and Australia, basically grew eight times. Malaysia is in the upper pack, having grown by 35 times.

The secrets of Asia’s successful transformation deserve repeating. During this period, there was peace and general political stability, with Asian governments being fiscally prudent and willing to invest in infrastructure and people. Asia did not follow the “import substitution” model adopted in Latin America but adopted the Japanese export industrialization route. Development essentially came from a young growing population that shifted out of rural agriculture into urban centres, with pragmatic governments working hand-in-hand with markets to create jobs in new industries and services.

This raised the savings and investment levels significantly above that of the rest of the world. The state took care of macroeconomic stability, education, health and infrastructure, preparing the labour force for foreign and domestic enterprises to propell exports and growth.

Those economies that were most open to technology and innovation, including welcoming foreign investment, grew fastest. Initially, income distribution improved, but in recent years, income and wealth inequalities have widened. Furthermore, climate change issues in terms of weather change, impact on water, food and increasing natural disasters are rising in the social agenda. The geopolitical temperature has also risen with the West feeling more insecure.

Currently, China’s rise is seen as the main geopolitical rival for the West, since she is the West’s largest market, biggest supplier, toughest competitor and rival political model. But not far behind China are India and Asean, both with a culturally diverse, younger population, totalling two billion people and a US$5.8 trillion GDP, about to enter into technologically driven, middle-class income levels.

Both South and South-East Asia are about to enjoy the same demographic dividend as China, but it will take competent governments to ensure that the rise to middle and advanced income will be accompanied by good jobs and fair distribution, particularly in the face of growing protectionism, and decoupling in technology and supply chains.

Asia’s growth must be in cooperation with the West, socially, commercially and technologically. But the greatest risks are the neo-con hawks in the West who are willing to risk war to disrupt Asia’s rise.

Put simply, if Asian growth stalls, the world will lose its growth engine.

The rise of Asia for the rest of the century is neither destiny nor pre-ordained. The West will not sit by to see its leadership erode. But as McKinsey’s useful analyses on the Future of Asia opined, “The question is no longer how quickly Asia will rise; it is how Asia will lead.” Leading in a culturally diverse and complex world is not about fighting, but about how to work together, meaning competing and cooperating at the same time. The greatest Asian divide is not technology, but social polarisation driven by race, gender, religion, ideology and health/wealth inequalities, all exposed brutally by the pandemic.

How a new generation of Asian leaders heal these social wounds and move forward without fragmentation and fighting will be the true test of Asia’s maturity in the next 60-year cycle.

How a new generation of Asian leaders heal these social wounds and move forward without fragmentation and fighting will be the true test of Asia’s maturity in the next 60-year cycle.Andrew Sheng is a Distinguished Fellow of Fung Global Institute, a global think tank based in Hong Kong. The views expressed here are his own.

Asia News Network

Source link

Related posts:

Why China manages to develop and rise despite talent outflow

Why China manages to develop and rise despite talent outflow

The US needs to ask itself: Nowadays, how many talents

worldwide will be less likely to do their research and contribute their

wisdom in the US? Can it still provide better education, better jobs and

better quality of life? The US had better not be too self-centered and

narcissistic.

China must be militarily and morally ready for a potential war

China must be militarily and morally ready for a potential war

China must be a country that dares to fight. And this

should be based on both strength and morality. We have the power in our

hands, we are reasonable, and we stand up to guard our bottom line

without fear. In this way, whether China is engaged in a war or not, it

will accumulate the respect of the world. One day, we will show our

natural dignity and power without flexing muscles, and we will win

without fighting a war.

Why Western media make malice toward China

Why Western media make malice toward China

Through the efforts of several generations, an open and

enterprising China through peaceful development has increasingly won

respect and support of the international community. And distorted

reporting under the double standards of the Western media will

eventually lose every ounce of their credit.

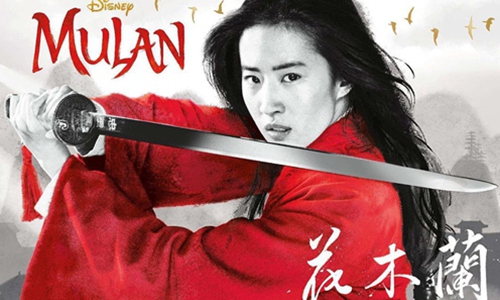

US anti-China politicians' stirring up controversy over Mulan film location just restless clamor

US anti-China politicians' stirring up controversy over Mulan film location just restless clamor

The recent controversies over Disney's filming of its

live-action movie Mulan in China's Xinjiang Ugyur Autonomous Region and

its credits thanking security and publicity departments in Xinjiang

which offered assistance to the filming did not end here. On Friday, a

bipartisan group of US lawmakers asked Walt Disney Co. Chief Executive

Officer Bob Chapek to explain the company's contacts with Xinjiang

during the production of the film.

China, Russia provide more certainty to the world as the US becomes a threat: expert

China, Russia provide more certainty to the world as the US becomes a threat: expert

With the world engulfed by the deadly coronavirus, rising

violence and a collapsing international order due to the US, China's

State Councilor and Foreign Minister Wang Yi said on Friday that

China-Russia relations have become the key force of stability in a

turbulent world.Related posts:

In four separate speeches, Secretary of State Pompeo (pic), Attorney General Barr, National Security Adviser O’Brien and FBI Director Wr.

China and the Decline of US Power

The deep historical roots of racism

The #Blacklivesmatter protests have countries around the world examining their own problems with race.

Colonialism

ColonialismWhy 'Gone With the Wind' should stay on HBO Max - Los ...