Broad measures spelt out under Budget 2020 will likely sustain the economy, if there is no further escalation in trade fights.

A glimmer of hope emerged after the US outlined the first phase of a deal to settle some issues related to trade, but there is a lingering suspicion that China could be just buying time as it will most likely not concede to any loss of sovereignty.

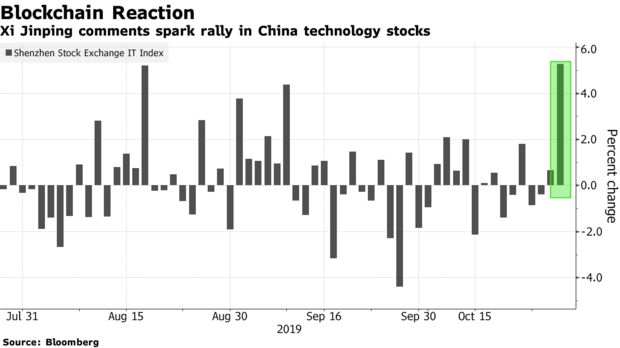

China is developing its own ecosystem that could be “outside the reach” of the US, and it is possible that the time bought with such rearguard actions may allow China to achieve its aims.

Malaysia, a trade dependent economy, can only hope that it all works out well, if it can integrate into both ecosystems, said Inter-Pacific Securities head of research Pong Teng Siew.

More stimulus measures would be undertaken should the global economy worsen and in the worst case scenario, Malaysia would have room to spend more if it increases the budget deficit, currently at 3.2% of the gross domestic product (GDP).

The worry is that a further deterioration in global trade tensions may push the global economy into recession. If that does not happen, these Budget 2020 measures should be able to sustain the economy, according to RHB Research Institute chief Asean economist Peck Boon Soon.

Given the external headwinds that continue to pose more downside risks, it looks like Budget 2020, which attempts to spread out its positive effects, has been designed to brace for rough times.

Some positive impetus could be derived from measures to support tourism, construction and infrastructure, as well as small and medium scale enterprises (SMEs), said AmBank Research head Anthony Dass.

Tourism-related businesses such as food and beverage, accommodation, travel and transport, shopping and entertainment will likely benefit.

Recognising the importance of SMEs in driving growth, a string of measures to facilitate their financing needs, ease of doing business, faster adoption of high technology and green initiatives, should also bode well.

The bottomline is that resources are limited while the government still aims for fiscal consolidation and repayment of all debts.

Spreading out these scarce resources will probably succeed in paring off any broad-based slowdown, but it will be hard to make a dent when the sense of a loss in economic momentum is gradually settling in, said Pong.

More measures are required to stimulate the economy but in view of the gloomy global outlook and domestic issues, it is still overall, a good budget.

However, the allocation between capital and operating expenditure is still imbalanced; there is too little capital expenditure and there appears to be ‘little effort’ to reduce operating expenditure.

This will have a long term effect, especially in an aging society, according to Areca Capital CEO Danny Wong. In view of concerns over the lack of investments and falling revenue, efforts to boost foreign direct investments and tourism are welcome but more robust steps are required.

A correction in property prices may be a remedy for the overhang and inaffordability issues especially among young people.

The budget tries to forestall a price pullback, which would affect developers stuck with high land prices, by allowing foreigners to fill the demand gap.

But demand has evaporated, partly caused by the migration of mid-level talent and delays in household formation, the driver of long term demand and new home construction. Developers, lulled by the padding of demand through low interest rates for borrowers, high financing margins and easy access to debts, find it hard to lower prices.

They had thought the elevated level of demand was sustainable but it was not. Reduced prices may mean less profits but possibly a lifeline by way of cashflows, and may help restore delays in household formation and loss of talent, said Pong.

A worrying trend is that more and more young Malaysians are moving out of the country in search of jobs.Even mid-level expertise and talent is migrating; previously, it was mostly those who were highly mobile internationally.

A major cause is the lack of growth in real purchasing power.

Is the projected GDP growth of 4.8% achievable?

With the government continuing its spending and development initiatives, growth should remain robust, supported by services and construction, higher production from agriculture and mining. But manufacturing is expected to moderate.

Malaysia can achieve its 4.8% growth target, said Hong Leong Bank chief operating operating officer, global markets, Hor Kwok Wai.

However, in view of slower world GDP growth of 2.8%, AmBank Research expects growth of 4.0% with an upside of 4.3% for Malaysia.

Coming up with a further set of stimulus, should things worsen, may be a challenge.

Columnist Yap Leng Kuen is watchful of the tech war. The views expressed are the writer’s own.

Source linkww

Read more:

Both China and the US still have resources to sustain a

trade war, but further consumption of those resources is unnecessary

since their goals have proved naive and absurd.

The situation is still highly uncertain, but the historical indicators

will gradually be corrected. China and the US will not get lost and the

world will benefit from the implementation of the consensus reached by

the two heads of state, assuming the responsibility to both countries

and the world and moving steadily towards the final end of the trade war

in stages.