-Photo credit Reuters.

PETALING JAYA: Several export-oriented sectors in Malaysia will be impacted if there is a prolonged shutdown of the US government, say industry players.

As one of the country’s largest export markets, contingency plans should be drawn up to assist the affected sectors in weathering the effects of the political impasse in Washington DC.

Associated Chinese Chambers of Commerce and Industry of Malaysia treasurer-general Datuk Koong Lin Loong said that while the impact of a short-term shutdown would be minimal, an extended one would create a ripple effect on the US economy and Malaysian exporters.

“If US civil servants are not paid their salary, this will decrease their spending power and consumption. This in turn will affect the export of our furniture to the United States.

PETALING JAYA: Several export-oriented sectors in Malaysia will be impacted if there is a prolonged shutdown of the US government, say industry players.

As one of the country’s largest export markets, contingency plans should be drawn up to assist the affected sectors in weathering the effects of the political impasse in Washington DC.

Associated Chinese Chambers of Commerce and Industry of Malaysia treasurer-general Datuk Koong Lin Loong said that while the impact of a short-term shutdown would be minimal, an extended one would create a ripple effect on the US economy and Malaysian exporters.

“If US civil servants are not paid their salary, this will decrease their spending power and consumption. This in turn will affect the export of our furniture to the United States.

“Also, the shutdown will interrupt services such as customs clearance at the ports and entry points in the United States. This will become an issue for our exporters.

“The disruption to the logistics sector would have an impact on the supply chain.

“This will be especially true for Malaysian companies involved in the export of electrical and electronics (E&E) products to the United States, which is a major importer,” he said when contacted yesterday.

The United States is one of the largest importers of Malaysian E&E, totalling almost RM120bil last year and representing about 20% of the country’s total E&E exports.

Of these figures, some RM60bil were semiconductor products, which account for about 20% of Malaysia’s total semiconductor exports.

Koong suggests that Malaysia leverage its position as Asean Chair to coordinate with other Asean members states and regional countries in facilitating exports.

“We could leverage the strength of Asean as a whole in respect of the individual countries’ niche products and services,” he added.

If there is a prolonged shutdown, he said the government should assist exporters by exploring other potential markets such as the Middle East and Africa.

Koong noted that development grants and soft loans, which were announced in Budget 2026, could help small and medium enterprises (SMEs) weather the effects of a prolonged shutdown.

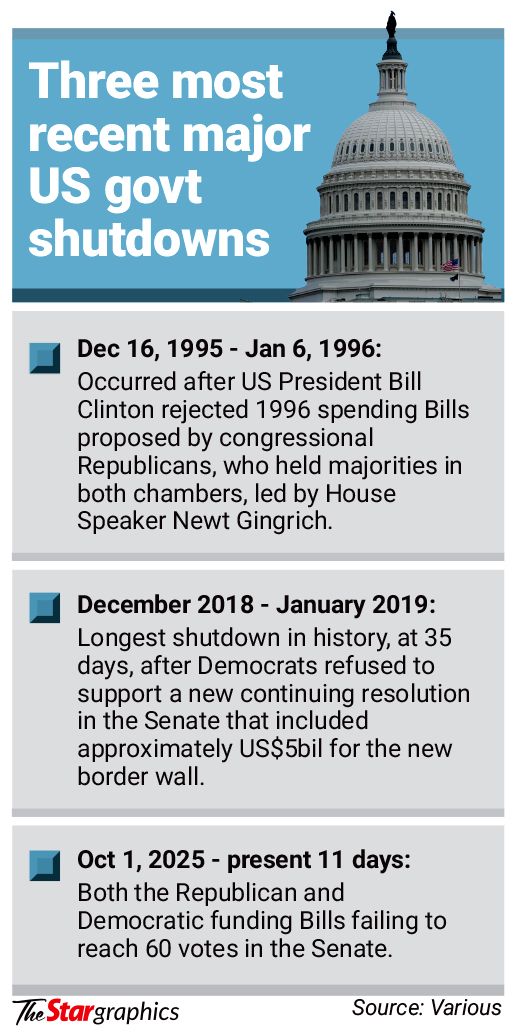

The US government shutdown, which began on Oct 1, was triggered by the US Congress’ rejection of a Republican funding Bill, resulting in some 750,000 federal government workers being furloughed without pay.

The deadlock is expected to persist for a third week despite pressure from President Donald Trump on the Democrats to support the Republican Bill.

Airfreight Forwarders Association of Malaysia chairman Thomas Mathew said the shutdown, though a US domestic political issue, carries far-reaching implications for the global economy.

“As one of the world’s largest importers and exporters, any disruption in the operations of US federal agencies reverberates through supply chains worldwide,” he said when contacted yesterday.

Among the immediate impacts of the shutdown are delays in customs clearance, port congestion and slower regulatory processing by key US agencies, he added.

“This includes the Customs and Border Protection (CBP), the Department of Commerce, and the Food and Drug Administration (FDA).

“These delays can significantly disrupt the flow of goods into and out of the United States, prompting re-routing, rescheduling, and increased costs across shipping networks,” he said.

Mathew said a prolonged shutdown would have a multifaceted impact on Malaysia, as the country is a key trading partner of the United States, particularly in the E&E and manufacturing sectors.

“Malaysia may encounter delays in order fulfilment, payment cycles, and reduced demand from US buyers facing their own domestic uncertainties,” he said.

He added that there could also be logistical slowdowns affecting compliance-dependent sectors that require US regulatory approvals, such as semiconductors, medical devices and pharmaceuticals.

“Additionally, any resulting market volatility may impact the ringgit, investor confidence and broader business sentiment in Malaysia,” he said.

While a short-term shutdown can be absorbed with minimal disruption, a prolonged one risks undermining the predictability and efficiency upon which global trade and export-driven economies rely on.

Mathew suggests that contingency plans are drafted for the affected sectors.

“Diversifying trade partnerships will be key for Malaysian businesses navigating such external shocks,” he added.

Malaysian Consortium of Mid-Tier Companies honorary president Callum Chen said a prolonged shutdown would be a double whammy to businesses, not only globally but also Malaysian too.

“The impact will make things worse. Ports in the United States are already jam-packed with stuck containers due to tariff uncertainties.

“Most US SMEs are already facing cash flow problems due to the tariffs,” he said when contacted.

He added that unpaid US federal workers would be forced to prioritise their spending.

“They will have less money to buy things, and their priority will be putting food on the table,” he said.

Chen expects the latest episode to be longer than the previous 35-day shutdown from Dec 22, 2018, to Jan 25, 2019, which is the longest in US history.

“Everyone is in a limbo and this only creates more uncertainty for businesses,” he said.

https://www.thestar.com.my/news/world/2025/10/11/white-house-says-substantial-us-government-job-cuts-have-begun

https://www.thestar.com.my/news/nation/2025/10/12/experts-theres-a-silver-lining-amid-us-shutdown

China's Ministry of Commerce (MOFCOM) on Sunday slamm

Related posts:

- https://bbc.com/news/articles/crrj1znp0pyo Anthony Zurcher North America correspondent and James FitzGerald Watch: What could happen du...