LuneX to provide funding to blockchain firms based in Malaysia

“Together with MAVCAP, we are actively looking for Malaysian-based blockchain startups, particularly in the early stage"

PETALING JAYA: Blockchain startups based in Malaysia can apply for growth funding from LuneX Ventures (LuneX), a Singapore-based dedicated blockchain and cryptocurrency fund.

Launched in 2018, LuneX partners Golden Gate Ventures, a venture capital firm that invests across South-East Asia.

Government-backed Malaysia Venture Capital Management Bhd (MAVCAP), the country’s largest venture capital (VC) firm, also invested in LuneX in 2019.

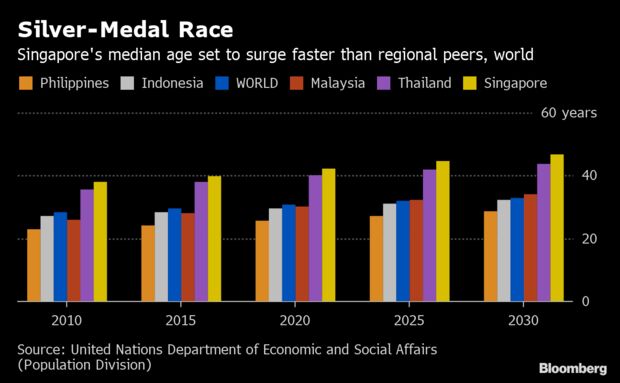

“Together with MAVCAP, we are actively looking for Malaysian-based blockchain startups, particularly in the early stage, to back and grow, ” said LuneX Ventures founding partner Kenrick Drijkoningen, noting that Malaysia has a lot of tech talent and a relatively young population picking up new trends rapidly.

“In Malaysia, we see the crypto finance movement being adopted by young people in droves, meaning for many of these products, there is a large market to find product market fit, ” he added.

Drijkoningen also pointed out there were bright prospects for blockchain start-ups in Malaysia as the country has a very open economy with a lot of cross border movement and finance - areas that blockchain technology will make significantly more efficient in years to come.

LuneX usually invests at the seed stage of financing, meaning the company is raising anywhere from US$100,000 to a few million dollars.

LuneX looks at whether the blockchain start-ups fits its investment thesis and the size of the markets they are operating in, in addition to the experience and passion of the founding teams.

“The best entrepreneurs are those who are able to pivot quickly if they see changing market conditions, ” said Drijkoningen.

He added that an oft-overlooked criteria is whether there is good working chemistry between the blockchain start-up and LuneX.

“An investment is very much a long-term commitment and working with each other should be productive, fun and an overall good experience for both parties, ” he said.

Drijkoningen said South-East Asia has boomed as a start-up ecosystem over the past 10 years and LuneX aims to ensure it also develops as a leading region for blockchain start-ups.

He recalled that while the blockchain ecosystem was heating up in 2017, there was no dedicated VC fund in South-East Asia specialising in the industry.

With this knowledge gap at traditional venture capital companies, it was hard for blockchain entrepreneurs to raise equity financing. Thus, tapping on the emerging blockchain ecosystem in South-East Asia, LuneX invests in blockchain and cryptocurrency-related early stage start-ups, as well as application tokens, protocol tokens, app coins andother digital and cryptofinance technology.

LuneX has a portfolio that is diversified across tokens in key players like Ethereum, Terra and Kyber; to equity in crypto finance infrastructural companies like Propine (custody), Merklescience (AML solution), Sparrow (Exchange) as well as blockchain application technology like Accredify and Keyless.

Other companies LuneX has invested in include Fleek, Stakewith.us, DEXTF, Blue Wallet, Accredify and Bank of Hodlers.

Drijkoningen said LuneX draws on a wide network to support its portfolio companies and help with business strategy, hiring, marketing and fund raising.

“Specific examples include placing senior management, working on a rebrand, introducing new round lead investors and helping prepare pitch decks, ” he said.

According to Drijkoningen, the Covid-19 pandemic has been positive for digital transformation and growth in blockchain and crypto finance has accelerated, as more things need to be done digitally.

“That being said, it has been more difficult to make investment decisions, as we do prefer to meet people in person, visit their office and spend some time socially.

“Nonetheless, we are in active talks with a number of start-ups and will continue to seek out opportunities to expand our portfolio, ” he said.

Regarding LuneX’s partnership with MAVCAP, Drijkoningen said both companies share similar long-term views and look to grow the industry together.

“MAVCAP has an amazing reputation and this helps with finding great talent and companies and providing them with the resources needed to succeed.

“Also, MAVCAP really understands how the future of finance, fintech and blockchain are merging into a new era of innovation, ” he said.

Meanwhile, MAVCAP CEO Shahril Anas said with blockchain technology being increasingly adopted in Malaysia, the VC firm saw the opportunity to increase availability of funding for innovative start-ups in this space and invested in LuneX.

“With our participation in this fund, we can provide greater opportunities for Malaysians entrepreneurs with innovative blockchain-based solutions, combining the expertise of LuneX in the blockchain industry with MAVCAP’s track record and deep knowledge of the local VC ecosystem, ” said Shahril.

He noted that LuneX has a wealth ofexperience in blockchain, which for MAVCAP is an uncharted sector.

“We are able to tap into the knowledge and experience of LuneX to provide training and actively engage with industry players, including regulatory bodies and start-ups, to create a conducive and secure blockchain framework for Malaysia.

“Also, our local VC talent pool gains technical know-how to be able to identify local start-ups with good potential and make investments in this sector, ” said Shahril.

Related posts:

BLOCKCHAIN beyond Bitcoin

Meanwhile, MAVCAP CEO Shahril Anas said with blockchain technology being increasingly adopted in Malaysia, the VC firm saw the opportunity to increase availability of funding for innovative start-ups in this space and invested in LuneX.

Meanwhile, MAVCAP CEO Shahril Anas said with blockchain technology being increasingly adopted in Malaysia, the VC firm saw the opportunity to increase availability of funding for innovative start-ups in this space and invested in LuneX.