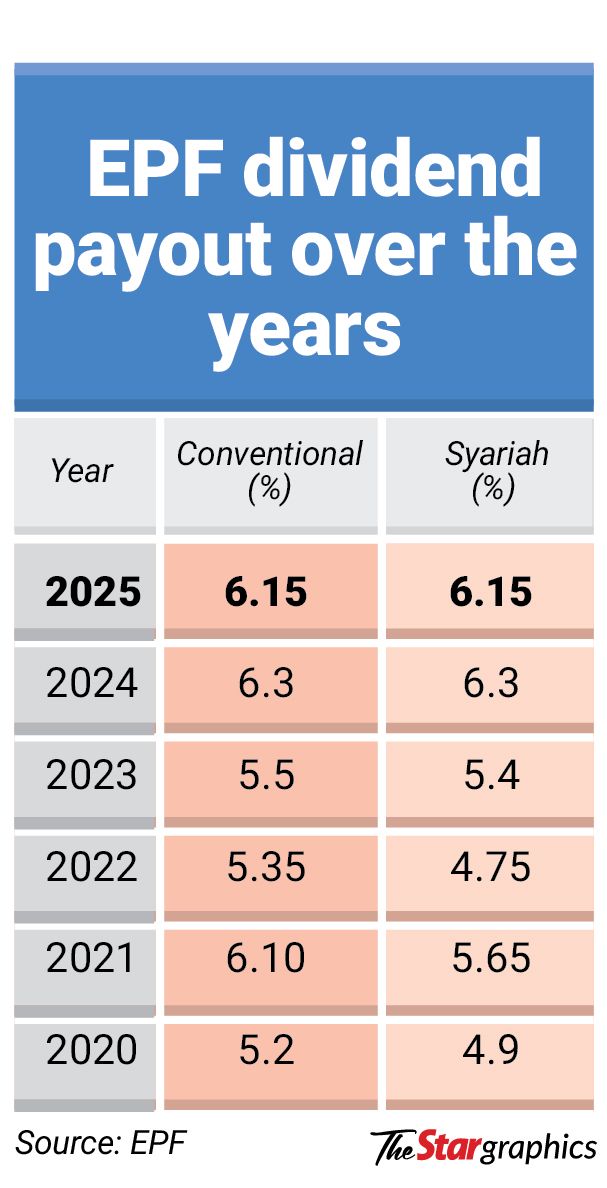

SHAH ALAM: The Employees Provident Fund (EPF) has declared a lower dividend for 2025 at 6.15% for both conventional and syariah accounts.

The total dividend payout for 2025 is RM79.6bil, whereby RM67.1bil is for conventional accounts and RM12.5bil for syariah accounts.

For 2024, the EPF declared a dividend rate of 6.3% for conventional savings with a total payout of RM63.05bil, as well as a 6.3% dividend for syariah savings, with a payout amounting to RM10.19bil.

EPF chief executive officer Ahmad Zulqarnain Onn attributed the lower payment to the slower growth of Bursa Malaysia’s Kuala Lumpur Composite Index (KLCI), which grew at 2.3% last year compared to about 12.9% in 2024.

Secondly, he said, assets denominated in the US dollar were also impacted due to the strength of the local currency.

The strengthening of the ringgit against the US dollar “impacted the value in ringgit of our income from dollar assets”, he said during the retirement fund’s dividend announcement yesterday.

“The ringgit does impact our international holdings and it was one of the best-performing currencies in the world, gaining 10.2%.”

The EPF recorded a total investment income of RM79.2bil for 2025, up from the RM74.46bil reported in 2024.

Investment assets grew to RM1.409 trillion, which is a 12.8% increase from the RM1.25 trillion recorded in the previous year, driven by portfolio income and net contributions of RM66.5bil.

The EPF recorded a total distributable income of RM82.7bil for 2025, up 9.5% from RM75.5bil in 2024.

Domestic investments continued to provide steady income, with 61.7% of the RM1.409 trillion worth of assets invested domestically. They generated investment income of RM39.3bil and accounting for 49.6% of total investment income.

Global investments, representing 38.3% of the portfolio, generated RM39.9bil and accounted for 50.4% of total investment income.

Ahmad Zulqarnain said the outlook for 2026 is moderate in the face of uncertainties.

“We believe economic growth will continue to be within expectations for most parts of the world, including continued growth in Malaysia,” he noted.

“Malaysia delivered 5.2% in 2025; the estimates are 4.3% for this year. But as we know, we also live in a world of great uncertainties, more so today than it has been for many decades.

“The risks are around trade policies, geopolitics, the path of inflation and, therefore, monetary policy and interest rates, increasing public debt, and the impact of artificial intelligence, which will create new winners and new losers. We believe Malaysia is in a good place,” he added.

“The top three themes for Malaysia that we believe will be persistent for the next decade are healthcare as we age as a nation, artificial intelligence, data and digitalisation as our personal and work lives become more and more digital, and energy as the world transitions to green energy.”

Meanwhile, the EPF will introduce the i-Legasi scheme, enabling contributors aged 55 and above to pass down their retirement savings to their children.

This scheme allows contributors to transfer their savings “intergenerationally” to their children. However, this applies only to members who are already eligible to withdraw their savings.

Ahmad Zulqarnain also said EPF dividends must be credited into the correct account as provided for under the law.

“If the savings are in Account 1 or Account 2, the dividends must be credited into those accounts,” he said.

“We cannot take dividends from other accounts and transfer them,” he said in reference to Arau MP Datuk Seri Shahidan Kassim’s suggestion that the dividends be channelled to the flexible account.